- ASIC released a consultation paper today seeking feedback on proposed changes to its Crypto Assets information sheet, which provides important guidance to crypto businesses.

- The existing information sheet was published in 2017 and is now largely outdated following several years of rapid progress in the crypto industry.

- ASIC commissioner, Alan Kirkland, said the update is intended to improve regulatory clarity, but also said perfect certainty isn’t possible.

Financial regulator, the Australian Securities and Investments Commission (ASIC), has today released a consultation paper outlining proposed updates to its cryptocurrency information sheet.

The cryptocurrency information sheet, known as Crypto Assets (INO255), is a key document for crypto-based businesses, being one of their main sources of information on crypto regulation and helping them ensure they’re compliant. The existing information sheet was first published in 2017 and is out-of-date due to the crypto industry’s rapid progress.

ASIC has also released a draft version of the updated information sheet for stakeholders to provide feedback on.

- The consultation period begins today and runs until February 28.

- The final updated information sheet is set to be published in Q2 of 2025.

Related: RBA Governor Says Bitcoin Not Money and Has ‘No Role’ in Australian Economy, as Bitcoin Temporarily Dips Below $89k

Advertisement

ASIC Seeks to Balance Innovation and Consumer Protection

ASIC Commissioner Alan Kirkland said the regulator is looking to update its guidance to crypto businesses in order to provide regulatory clarity and to balance the competing needs of driving innovation and protecting consumers:

We want to promote the growth of responsible financial innovation while ensuring consumer protection. A well-regulated financial system benefits everyone in the community as it supports consumer confidence, market integrity and facilitates competition and innovation.

Alan Kirkland, ASIC Commissioner

Alan Kirkland, ASIC Commissioner

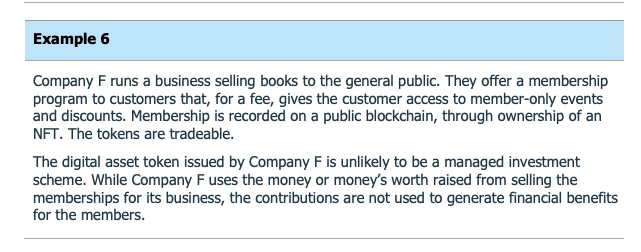

The proposed updates feature 13 practical examples of how a range of crypto products and services — such as memecoins, real-world asset tokenisation and leverage trading — fit into the current regulatory framework.That is, whether the digital asset or how it’s offered means it’s actually a financial product regulated under the Corporations Act.

Above: One of the 13 example scenarios provided in ASIC’s draft information sheet.

Above: One of the 13 example scenarios provided in ASIC’s draft information sheet.

Speaking to Capital Brief, Kirkland also said that despite the updated guidance there will still be some ambiguity around crypto regulation given its inherent complexity:

The key thing that people have said to us is that they would like more regulatory certainty and that’s something that we can never entirely provide. There is never 100% regulatory certainty.

Alan Kirkland, ASIC Commissioner

Alan Kirkland, ASIC Commissioner

According to ASIC, the updated guidance will generally follow guidance for non-crypto businesses, with the regulator saying that its “existing approach to financial services licences will apply to digital assets”.

The regulator explained this further using the example of securities — which seems a little odd given the debate about whether cryptocurrencies should be treated as securities — saying that “whether an applicant is proposing to deal in traditional securities or securities based on a digital asset platform, the same licensing regime applies.”

Related: ASIC Rebuked for ‘Misleading’ Statement, Ordered to Pay Costs as Block Earner Wins Key Ruling

In September, ASIC said that all crypto-related businesses operating in Australia will be required to have an Australian Financial Services License following its mixed results in legal battles against Aussie crypto companies Finder Wallet and Block Earner.